Online application for EPF Withdrawal

Submission of an online application for EPF Withdrawal

Interestingly, the EPFO has very recently come up with the online facility of withdrawal, which has made the entire process more comfortable and less time-consuming.

Prerequisite:

To apply for the withdrawal of EPF online through the EPF portal, make sure that the following conditions are met:

- The UAN (Universal Account Number) is activated, and the mobile number used for activating the UAN is in working condition.

- The UAN is linked with your KYC, i.e. Aadhaar, PAN and the bank details along with the IFSC code.

If the above conditions are met, then the requirement of attestation of the previous employer to carry out the process of withdrawal can be done away with.

Steps to apply for EPF withdrawal online:

Step 1: Go to the UAN portal by clicking here.

Step 2: Log in with your UAN and password and enter the captcha.

Step 3: Then, click on the tab ‘Manage’ and select KYC to check whether your KYC details such as Aadhaar, PAN and the bank details are correct and verified or not.

Step 4: After the KYC details are verified, go to the tab ‘Online Services’ and select the option ‘Claim (Form-31, 19 & 10C)’ from the drop-down menu.

Step 5: The ‘Claim’ screen will display the member details, KYC details and other service details. Enter the last four digits of your bank account and click on ‘Verify’.

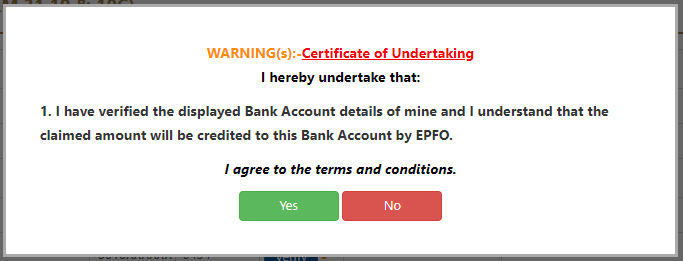

Step 6: Click on ‘Yes’ to sign the certificate of the undertaking and then proceed.

Step 7: Now, click on ‘Proceed for Online claim’.

Step 8: In the claim form, select the claim you require, i.e. full EPF settlement, EPF part withdrawal (loan/advance) or pension withdrawal, under the tab ‘I Want To Apply For’. If the member is not eligible for any of the services like PF withdrawal or pension withdrawal, due to the service criteria, then that option will not be shown in the drop-down menu.

Step 9: Then, select ‘PF Advance (Form 31)’ to withdraw your fund. Further, provide the purpose of such advance, the amount required and the employee’s address.

Step 10: Click on the certificate and submit your application. You may be asked to submit scanned documents for the purpose you have filled the form. The employer will have to approve the withdrawal request and then only you will receive money in your bank account. It usually takes 15-20 days to get the money credited to the bank account.

3. How to Apply for Home Loan Based on EPF Accumulation?

You can follow the procedure given below to apply for a home loan based on your EPF account balance:

Step 1: Apply for a home loan through the housing society to the EPF Commissioner in the format specified in Annexure 1.

Step 2: The Commissioner will issue a certificate which states the monthly contribution to your EPF account over the last three months. Alternatively, you can take a printed copy of your EPF passbook to show the last three months contribution.

Step 3: You can opt for a lump sum payout or instalments.

Step 4: EPFO makes the payment to the housing society directly.

4. Frequently Asked Questions

Q. Are EPF contributions eligible for tax deductions? A. Yes, EPF contributions are tax-deductible under Section 80C of the Income Tax Act, 1961.

Q. Can I increase my EPF contributions? A. Yes, you can increase your EPF contributions and contribute up to 100% of your basic pay. This is called VPF.

Q. Will employer also contribute higher when I do? A. No, the employer’s contribution will still remain the bare minimum regardless of you opting for VPF.

Q. Do I need employer’s permission to withdraw EPF from EPF? A. The new amendments have meant that the employer’s permission is not needed to make the EPF withdrawals.

Q. Can I make premature withdrawals? A. Yes, on meeting certain conditions, you are allowed to make premature withdrawals, and you need to produce documentary evidence for the same.

Comments

<a href="http://www.connect2payroll.com/services/hr-consulting-temporary-staffing”>Payroll Outsourcing company in Ahmedabad</a>

nICE ARTICLE

Payroll Outsourcing company in Ahmedabad

nICE ARTICLE

Payroll company in Ahmedabad